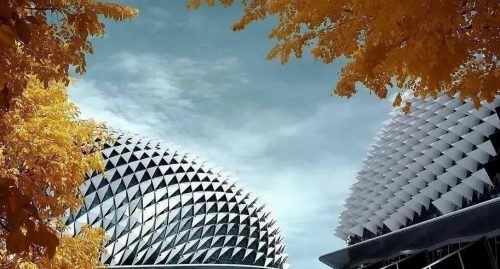

Singapore’s GIC rethinks China strategy after significant pullback

新加坡主权财富基金GIC重新考虑对华投资战略

Sovereign fund has reduced private investments following Beijing’s tech crackdown and property market turmoil。

在中国科技行业整顿和房地产市场动荡之后,GIC减少了对华私募投资,但其将“继续探索长期机会”。

Singapore’s sovereign wealth fund GIC has put the brakes on private investments in China as it steps up scrutiny of risks in the world’s second-biggest economy.GIC, one of the world’s largest investors in private equity funds, has scaled back commitments to China-focused private equity and venture capital funds over the past year, five people with knowledge of the matter said. It has also significantly slowed the pace of its direct investments in private Chinese companies.

新加坡主权财富基金——新加坡政府投资公司(GIC)已对在华私募投资踩下刹车,该基金正在加强审查这个世界第二大经济体的风险。

Although GIC was an early backer of China’s economic growth story, some of the fund’s most senior figures have struck a more cautious tone on investing in the country during internal discussions over the past year, two of the people said.

五名知情人士表示,全球最大的私募股权基金投资人之一GIC过去一年缩减了对投资于中国的私募股权和风险投资基金的承诺。它还大幅减缓了对中国私人企业的直接投资。

The fierce debate inside one of Asia’s most powerful sovereign wealth funds reflects concern over how some of Chinese president Xi Jinping’s policies might affect investors despite the end of “zero-Covid” curbs that hit growth last year.

尽管GIC是中国经济增长故事的早期支持者,但两名知情人士称,过去一年,该基金的一些最资深人士在内部讨论中对于投资中国表达了更谨慎的态度。